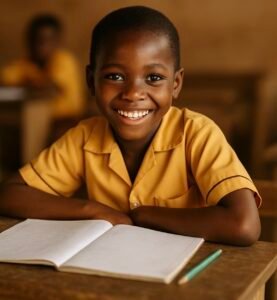

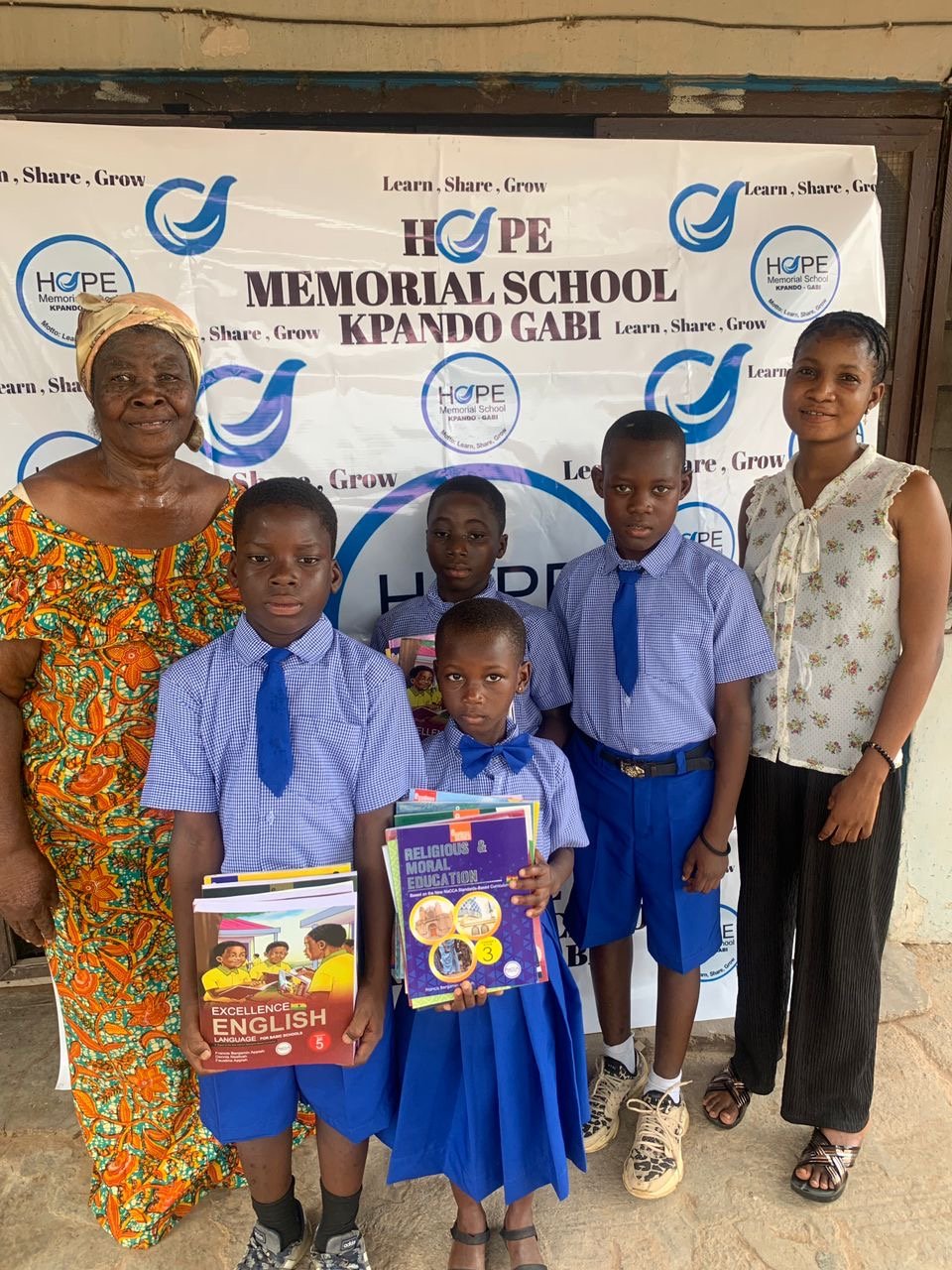

Feeding & Nutrition

We provide meals and nutrition support that help vulnerable children stay healthy, attend school consistently, and grow strong. Your support fuels feeding outreaches, school meals, and emergency food relief.

- School & outreach meals

- Emergency food support

- Nutrition for learning